Beth Schechter's world shattered with a text message.

An Atlanta native, Schechter moved to Portland in 2015 to take a job as executive director of a nonprofit called the Open Cannabis Project in 2017. Her job: protecting small cannabis farmers by challenging patent claims on commonplace weed strains.

For two years, she was a happy warrior, collecting chemical and genetic data from pot plants and every now and then checking in with Mowgli Holmes, a geneticist and entrepreneur who was cataloging the plant DNA.

Then, this April, someone texted her a 25-minute video.

It showed Holmes pitching his company, Portland-based Phylos Bioscience, to investors at a conference in Miami. It also seemed to show she had unwittingly sold out those small farmers.

"To be honest, at first, I had no emotional reaction at all," Schechter, 37, says. "It really took a few days to process and be like, 'Wow, shit.' Probably, the numbness in my body was shielding me from that so I wouldn't just crumple into a ball."

Since 2014, Phylos Bioscience—a startup founded by Holmes, a Ph.D. from Columbia University—had been collecting DNA samples from plants and publishing the data for the public.

Phylos and OCP both said they pitted themselves against companies like Monsanto, and often talked about working together to fight "corporate weed."

But in the video, which has now gone viral within the cannabis industry, Holmes told investors that his firm—a testing company that didn't grow flower itself—would now start breeding its own cannabis plants, seemingly competing with the very growers he had been getting DNA from.

And he told investors he had a head start.

"It would be impossible for anyone else to collect this dataset at this point," Holmes told the venture capitalists in February. "We are fully integrated in the cannabis industry. We have more trust in the cannabis industry than any other science company."

Holmes appeared to imply to the Florida investors that Oregon cannabis farmers had handed him the genetic passwords to unlock their secrets and get filthy rich by selling to Big Ag.

Holmes says that is a misunderstanding, because Phylos will not use the data it collected from customers to breed. He also says Phylos won't compete directly with craft farmers. But to Schechter and now much of the Oregon cannabis community, the pitch undermined every promise he had ever made to growers.

Describing the effects of the video as "shock and anger," Schechter announced May 6 that she was quitting and the Open Cannabis Project would shut down at the end of the month.

Phylos had misled her, and a tight-knit community of growers, Schechter says, by presenting itself as a testing company that would never breed plants.

"No matter what we do as an organization going forward, Open Cannabis Project will never escape this deception," Schechter said when she announced her nonprofit would close.

The Phylos video reverberated through Oregon's tightly knit cannabis industry. Not only did the company sacrifice all of its goodwill among small, craft growers, but it took down a nonprofit, cost at least one grow operation $50,000, ended friendships—and may soon result in lawsuits.

"[Phylos] ingratiated themselves in our community as a way to protect genetics that some of us have been developing for years and years," says Myron Chadowitz, who owns an award-winning cannabis grow called Cannassentials near Eugene, and has given strains to Phylos to be genetically tested.

But the star-crossed rollout will not end Phylos. The bioscience company expects to survive the fiasco because it still has more than $14 million in investments from venture capitalists.

For Holmes, a 47-year-old with a laconic style who brought to Oregon a distinguished background as an AIDS researcher, the backlash feels staggering.

"People we love and support," Holmes says, "think we're evil all of a sudden."

Oregon's legal cannabis industry was supposed to be edenic. Voters legalized recreational weed amid promises that the end of prohibition would free people from prison and put money and power into the hands of those beleaguered by the war on drugs. Cultivators hand-selected buds lovingly sprouted in greenhouses with controlled climates and organic fertilizers.

Holmes finds himself both a scoundrel and one with cash—a genuine reflection of an industry, less than five years after the state legalized recreational weed, that has shifted from a DIY craft to a hard-edged business.

The shift to a legal market has created an oversupply and resulted in financial winners and losers. Phylos is probably one of the winners. But the company has lost something many pioneers thought essential to Oregon cannabis: its innocence.

Nathan Howard, one of the co-founders of East Fork Cultivars, located in Josephine County, says Holmes' videotaped pitch to investors is emblematic of the rush toward corporatization.

"It feels like a pivotal moment for Oregon cannabis in particular," says Howard, whose company severed its partnership with Phylos Bioscience after the investor video surfaced.

"Is [cannabis] like every other trade?" Howard asks. "Or is this actually something special? There is a big pot of money, and some shitty decisions are being made right now about the soul of Oregon cannabis."

On an electric, blue-lit stage in December 2015, long before his video went viral, Holmes told the story of how cannabis traveled around the globe, adapting to new environments in every corner of the earth where humans planted seeds.

With the disheveled hair of an absent-minded professor, Holmes, who earned his Ph.D. in microbiology and immunology from Columbia University, predicted the cannabis industry would soon be gobbled up by profit-driven agricultural and pharmaceutical giants.

"There's sort of this magic period right now where people are doing all of this stuff and we're not competing with Genentech and Pfizer and Merck and Syngenta and Monsanto," he told a crowd of software developers at TechfestNW, a conference organized by WW's parent company. "We've probably got two years left of that."

Holmes often said he wanted to protect the cannabis industry from the likes of Bayer, Dupont and Monsanto.

A native Oregonian, he grew up on a commune in the woods near Dexter southeast of Eugene. He says his parents were East Coast anti-war activists who moved to Oregon to live as "back-to-the-land hippies."

He moved back to Oregon in 2013 to start Phylos Bioscience with his business partner Nishan Karassik, who grew up near Holmes' family. Since they were kids, their families have worked the same booth together at the Oregon Country Fair.

"The cannabis industry was just blowing up," he says, "and there was obviously no science."

Holmes spent late nights over drinks, talking with lifelong weed devotees, convincing them he had the best interests of craft farmers at heart. The soft-spoken, earnest scientist easily won people's trust.

"I will never be as easily taken advantage of again by a business partner," says Jeremy Plumb, a cannabis entrepreneur who considered Holmes a friend and founded the Open Cannabis Project with him before Schechter took over. "I do feel deeply betrayed."

Phylos sold its genetics tests as a way to help craft growers.

"We were told [Phylos] would give us the ability to speed up our breeding programs," says Chadowitz, the Eugene grower. "They were selling their genetics services as a way of protecting us, as opposed to letting us know those genetics they're going to use to help their future breeding program."

In an essay published in High Times, a former Phylos employee reflected on the company's "script" for coaxing growers into submitting genetic samples.

"I reassured you time and again, hundreds of times daily," Dick Fitts wrote. "We are not out to steal your work. We are here to help you protect it, to prove prior art. We're a different type of cannabis company. We fucking hate Monsanto. We fucking hate Monsanto. We fucking hate…"

In the beginning, Phylos Bioscience simply tested samples to determine a plant's gender and to sequence the strain's DNA.

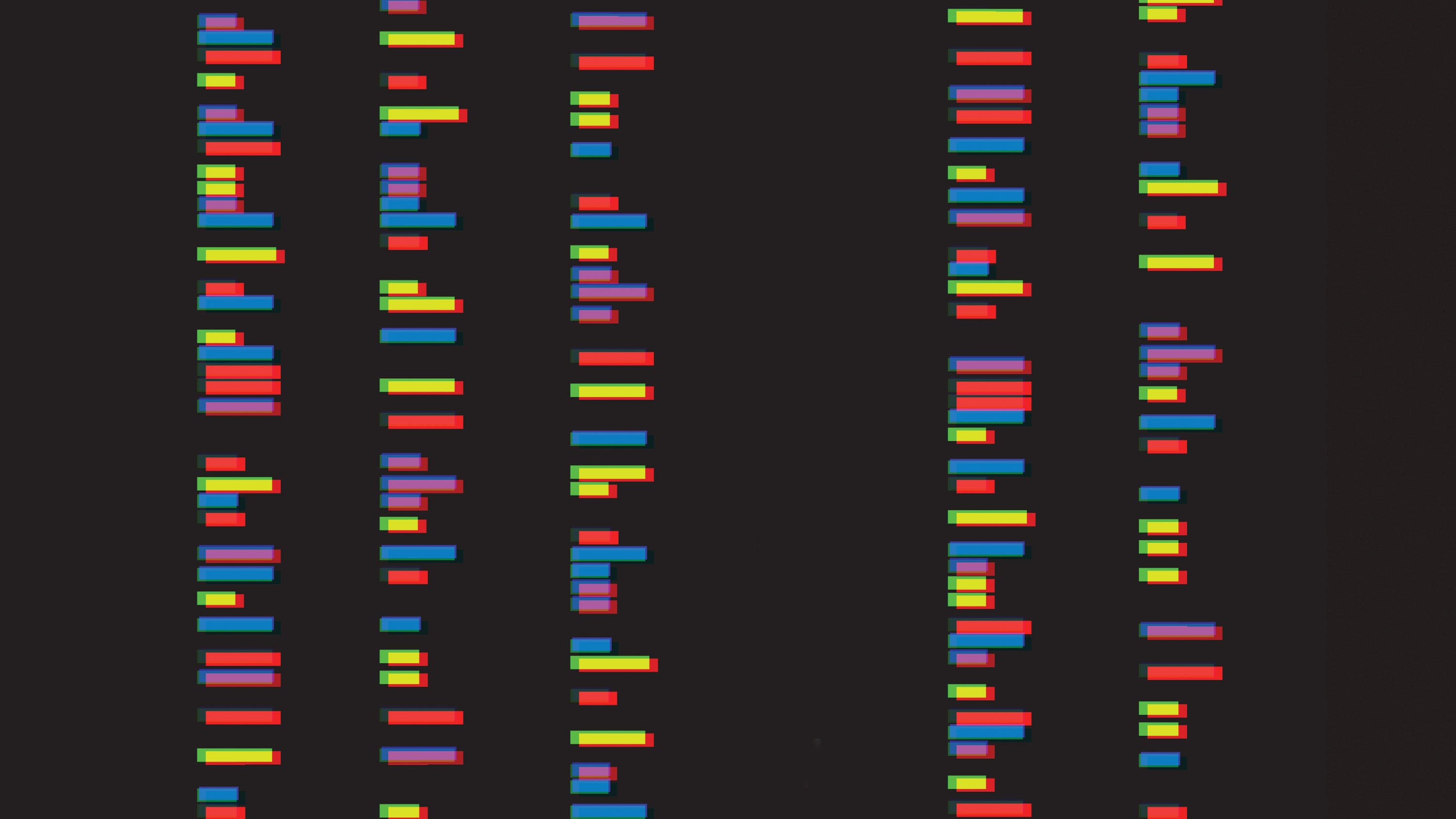

In Holmes' lab, scientists collected more than 3,000 samples from dead cannabis stems. They pulverized the stems, ruptured cell walls, and pulled long, stringy DNA from the nuclei. Holmes' team analyzed the genomes and placed each unique strain on a three-dimensional map that showed how closely the samples were related and how much diversity existed among cannabis plants.

But that business model alone didn't produce profits that would attract investors and potentially court a large corporation to eventually buy Phylos. A little more than two years ago, Holmes says, the lab started considering a breeding program, first through partnerships with existing growers.

"For a long time, we didn't think we would do breeding," he says, "but grow operations can't support a real breeding program. Doing the breeding ourselves, in a way, that felt really natural to us."

He says Phylos wants to breed disease-resistant strains of industrial hemp to make money, in addition to chemically superior strains of cannabis that he promises the company would release under open-source licenses.

"We're going to try to be dominant in the international hemp industry," he says. "It's not possible and we don't want to be the dominant breeder in the craft cannabis industry."

Even before Phylos announced its plans to get into breeding, its work set many cannabis cultivators on edge. The skepticism followed anyone who worked with the bioscience company.

Suspicious emails accusing the Open Cannabis Project of shady dealings started circulating long ago, alleging the nonprofit was a front to collect DNA that could be used to make investors rich.

"For the past year and a half, part of our story has been fielding emails from people in the community calling us a scam," Schechter says. "We were like, 'What? Why? What are you talking about?'"

Now, the allegations make more sense.

Since 2014, Phylos has sought several rounds of venture capital funding. PitchBook, which tracks investments in startups, says Phylos Bioscience has raised $14.09 million. Holmes confirmed that figure.

PitchBook also says one of the company's primary investors is Slow Ventures, a San Francisco investment firm. Slow Ventures' founder did not respond to a request for comment on this story.

Holmes says the investors arrived with priorities different from his own.

"Our investors don't understand why we want to help [craft growers]," he says. "We have investors who say, 'Why are you worried about the small farmers? They're not going to be your best customers.' And from a purely business standpoint, it doesn't help us to engage in that community."

Venture capital has changed the face of Oregon cannabis. Last month, Cura Cannabis, a company that sells oil concentrates extracted from marijuana plants, made the Oregon weed industry's largest-ever profit when it sold for more than $1 billion. But many growers feel the infusion of venture capital has mutated the industry.

"I think this is part of what we're grieving," Schechter says. "We had this ideal that Oregon could do it different."

On April 16, two months after Holmes pitched his company to investors in Florida and told them he was going to start breeding and that the data he had collected for four years gave him a leg up, Phylos Bioscience announced its breeding program to the world with a promotional video posted to Instagram and YouTube.

"We're working with breeders and growers all around the world now to make outrageous new weed," Holmes says in the video.

Phylos meant for the message to be inspiring. Growers heard a threat.

(Kennedy Barrera-Cruz)

(Kennedy Barrera-Cruz)

Reactions poured in on social media. Growers criticized Holmes for once vowing not to breed plants—an allegation Holmes disputes—collecting DNA under false pretenses, and then using the genes to gain an unfair advantage in the market.

"Didn't you guys steal a bunch of genetics?!!?" one wrote. "Not cool."

"You guys should be ashamed of yourself," opined another, "to con your way into our community with lies."

Phylos tried unsuccessfully to assuage growers' fears by saying it was not stealing anyone's plants. But backlash intensified days later, when the video of Holmes pitching his company to Florida investors surfaced.

"We have a really huge lead. We've been collecting data and IP for four years," Holmes told prospective investors. "It's never really possible to do real plant breeding in your basement, and today, plant breeding depends on this whole set of technologies. All of them are driven by genomic data, and Phylos has the biggest collection of genomic data on cannabis in the world."

The extent of his advantage is unclear. But Holmes had voiced the precise fear growers had expressed on social media.

The people closest to Holmes, who had encouraged farmers to share genetic data with Phylos, felt they had been double-crossed by a friend.

"I really was used as an instrument of their will," says Plumb, who helped promote Phylos by working with the company and regularly speaking with Holmes at conferences and events. "I bought into their message that they were going to do it better."

In other corners of the cannabis industry, the fallout poisoned several enterprises that had varying degrees of partnerships with Holmes and Phylos.

On May 3, Cultivation Classic—an organic cannabis competition hosted by WW each spring—severed ties with Phylos. In prior years, the event had partnered with Phylos to genetically test and add competing strains to the company's Galaxy project. Those samples expanded the genetic data Phylos had.

"It was a major PR crisis, and a crisis of ethics and integrity," says Stephanie Barnhart, director and co-founder of Cultivation Classic.

Less than a week later, East Fork Cultivars also killed a planned partnership with Phylos Bioscience, in which Phylos would offer advice and expertise from company scientists for a special breeding program East Fork was investing in.

"There are a lot of questions out there that have not been answered," Howard says. "We hope that people are proven wrong."

Still, Howard and East Fork co-founder Mason Walker have cut Holmes and Phylos out of their business.

Holmes says he didn't get a chance to explain himself to his partners who ditched Phylos after the video.

"Many of our partners never reached out to us to find out what was true and what wasn't," he says.

Schechter choked back tears as she spoke of her damaged friendship with Holmes.

"I think that, honestly, this was the most painful part of this whole situation," she says. "There's going to be fallout that includes the loss of friendship through this, and I think that's the most devastating thing. I don't know what's going to happen next."

Holmes has lost some of his closest friends in the industry. He's been the subject of Instagram memes—a dozen images riffing on The Jungle Book—and online threats.

"You learn a lot about human nature," he says, "and mob behavior and loyalty. You learn stuff you didn't know before."

His company faces legal hazards, too. No lawsuits have been filed, and it does not appear Phylos violated the terms of its data agreements with growers who bought genetic tests. But several industry insiders mentioned possible lawsuits, including a potential class action suit against the company.

Holmes started Phylos with a promise that his company would help fight corporate interests willing to compromise ethics to make money. He concedes that by failing to tell a consistent story to growers and investors, he made an ethical misstep.

"It's been a failure on our part," he says. "It seemed like we were lying."

At the very least, Holmes misled growers about his intentions to breed cannabis within Phylos. He claims he wasn't lying to breeders or investors, but he was talking to each group in a different voice.

"I was talking in this way that you speak to investors," he says. "It's cold and it's about money. It's weird to have one foot in the community, that's really a community, and one foot in the business world, where it's just math."

Plumb, his former friend, calls the company a "wolf in sheep's clothing." He predicts it could be purchased by a major agricultural company.

"They're effectively, for all intents and purposes, at this point in the market, an agent for Bayer scientists," he says.

Holmes doesn't entirely deny this.

"Most of my investors have heard me say, 'Just so you know, we don't want to sell to one of those Big Ag companies,'" Holmes says. "Of course, I can't say definitively what will happen. I just can't."

The bioscience company will probably either continue to grow and become the dominant player in cannabis science, or it will sell when Big Ag companies like Bayer decide to start buying up competitors.

But from Holmes' perspective, if Phylos Bioscience doesn't invest in improving the cannabis plant, a company like Monsanto will.

"A big science company is coming in," he says. "They're going to do all this. We're the last science company to come into the cannabis industry who grew up on communes."

He says he hopes the cannabis community can forgive Phylos so that the company can give back to small farmers.

"For days, we stopped and asked, 'Are we doing something evil?'" he says. "In the end, we're not. We're driven by morals and ethics more than anyone else."

Few weed cultivators are ready to forgive.

At Cultivation Classic last weekend, the topic of the Phylos blowup had attendees on the edge of their seats. No one spoke up to defend the company's actions.

Chadowitz of Cannassentials sees the Phylos controversy as a test of Oregon values when deep-pocketed investors seek to take over the industry.

He thinks Phylos flunked.

"Ethics in big money is becoming a major player in the way we all think," he says. "What are we all going to do when we're faced with a situation where we can get millions and millions of dollars for stuff we've been working on?"

Good Money

Phylos Bioscience is not the only cannabis company willing to trade goodwill for cash.

The blow-up over Phylos Bioscience's breeding program is just the latest example of a growing fear among farmers that venture capital is warping Oregon weed.

"Cannabis is not immune to the influences of capitalism," says Mason Walker, co-founder of Takilma, Ore., farm East Fork Cultivars.

When recreational weed was legalized, Oregon policymakers created a free-for-all licensing structure that flooded the market with cheap flower. Many fear only those with enough capital to wait out the glut will survive.

Meanwhile, well-funded investors from out of state have flocked to get a piece of Oregon's market. Investors from Canada, where federal laws allow banks to accept deposits from marijuana companies, snapped up quirky Oregon dispensaries and spun out chains of weed shops with atmospheres that call to mind Apple stores or Plaid Pantrys.

One of the big winners in the increasingly competitive cannabis market has been Cura Cannabis, an extract company that recently sold to a Canadian firm for a reported $1 billion in stock, making it the largest pot startup in the state. But Cura has a complicated history.

As first reported by The Oregonian this month, Cura benefited from a real estate scheme that gambled with $1 million from its investors' retirement funds. The company says Cura executives did not know about the illegal funding, and when they found out, they returned about $500,000 to the duped investors in 2016.

Two years before that, former Cura CEO Nitin Khanna, who made his first fortune in the tech industry, faced a rape allegation from a hairdresser working at his wedding. Khanna denied the allegations, and prosecutors declined to indict him, saying they couldn't "prove this case beyond a reasonable doubt."

The company sought legal action against people who resurfaced the allegation last year, in what Cura believes was a coordinated attack against its business. Khanna remains a board member and investor.

Cura isn't the only Oregon company in hot water.

Another lawsuit, filed last month in Clackama County Circuit Court, names as its plaintiff a Vancouver, B.C., company called C21 Investments, which has been buying up smaller farms across Oregon. The former owners of one of those grows, Eco Firma Farms, sued C21 for allegedly diverting cannabis to Las Vegas.

The lawsuit, first reported by the Portland Business Journal, says C21 smuggled the weed to Nevada to supply a cannabis bar at an event sponsored by the company.

"The marijuana items required to 'stock' the dab bar were illegally smuggled in a van to Nevada from Oregon," the suit alleges, "in violation of Oregon, Nevada and U.S. federal law by C21, Phantom, Swell and their executives, all of whom had actual knowledge of the smuggling and in fact authorized and directed it."

Observers are gloomy.

"It's such a bummer to see what's happening," says Walker's business partner Nathan Howard. "The biggest corporate actors are really disappointing, and they're about the most talked-about Oregon cannabis companies."

Another Man's Treasure

Did Phylos Bioscience really steal anything?

In the wake of cannabis-industry backlash, Phylos Bioscience has tried to reassure growers it did not steal anyone's plants—or gain a DNA roap map to copying craft strains of weed.

"We can't steal their actual plants," Holmes says. "We wouldn't do that. It would be illegal to do that. And, scientifically, if you have a piece of dead [plant] material, you can't bring it back to life. That would be like bringing a person back from a fingernail."

The company says it isn't using its customers' data for breeding, but even if it wanted to, it can't do much with the DNA it collected from growers over several years. That's because it has only the genotypes—the DNA sequences—for each plant, and the DNA sequences only look at 2,000 sites on the genome. Holmes says scientists need sequences with thousands more sites to do genetic marker-assisted breeding.

To translate that data into a breeding program, Holmes says his scientists would have to know which traits were linked to certain genetic markers, something the company could do only if it also had a database of the phenotypes, or expressed traits, and the chemical makeup of each plant. Without detailed phenotypes and chemotypes, Phylos says it cannot develop genetic markers from the dataset.

Is the data truly useless?

"Ultimately, the answer is 'kind of,'" says Beth Schechter, who ran the Open Cannabis Project, a nonprofit that worked with cannabis genetics until this month. "They have genetic information, and with genetic information on its own, you can look at that genetic information and see if you can find patterns. Out of context with chemical data that goes with it, and information about the breeding and growing, you can't do the kind of powerful breeding they're talking about."

Still, the patterns Phylos might discern from the data could prove useful to guide early decision-making in the breeding program, she says.

"What you can do is say these are some common genes and some uncommon genes," Schechter says. "There's still a lot that you can learn."

Some breeders feel the company had been disingenuous in order to gain an advantage by collecting their genetic data.

"They're not stealing our intellectual property, they're just using our data sets in ways that are going to be advantageous," says Myron Chadowitz, who runs Eugene's Cannassentials.

His farm submitted two strains to the Phylos Galaxy project, with the understanding the genetic tests would help protect the farm's cannabis from being patented by other companies.

"Without knowing they were going into a breeding program, my assumption was 'Why would I not want my genetics in the public realm?'"he says. "Now, they have a leg up on all of us. They can pop 10,000 seeds, test the leaves within days of them sprouting, and look for the genetic data that we've given them. They can do in a matter of weeks what takes me nine months."

Chadowitz says the ethical quandary mirrors larger concerns about data privacy that have taken hold in the 21st century.

"It's the same thing that's going on with Facebook right now," he says. "It's something we all have to come to grips with. Every bit of information we give out is going to be used by someone in some respect."

Correction: This story originally misstated when Beth Schechter began working for the Oregon Cannabis Project. She took the job in 2017.