U.S. Sen. Ron Wyden (D-Ore.) has long had it out for Opportunity Zones—low-income areas that offer heaping tax cuts to wealthy investors if they put money in things that might bring economic activity to struggling communities.

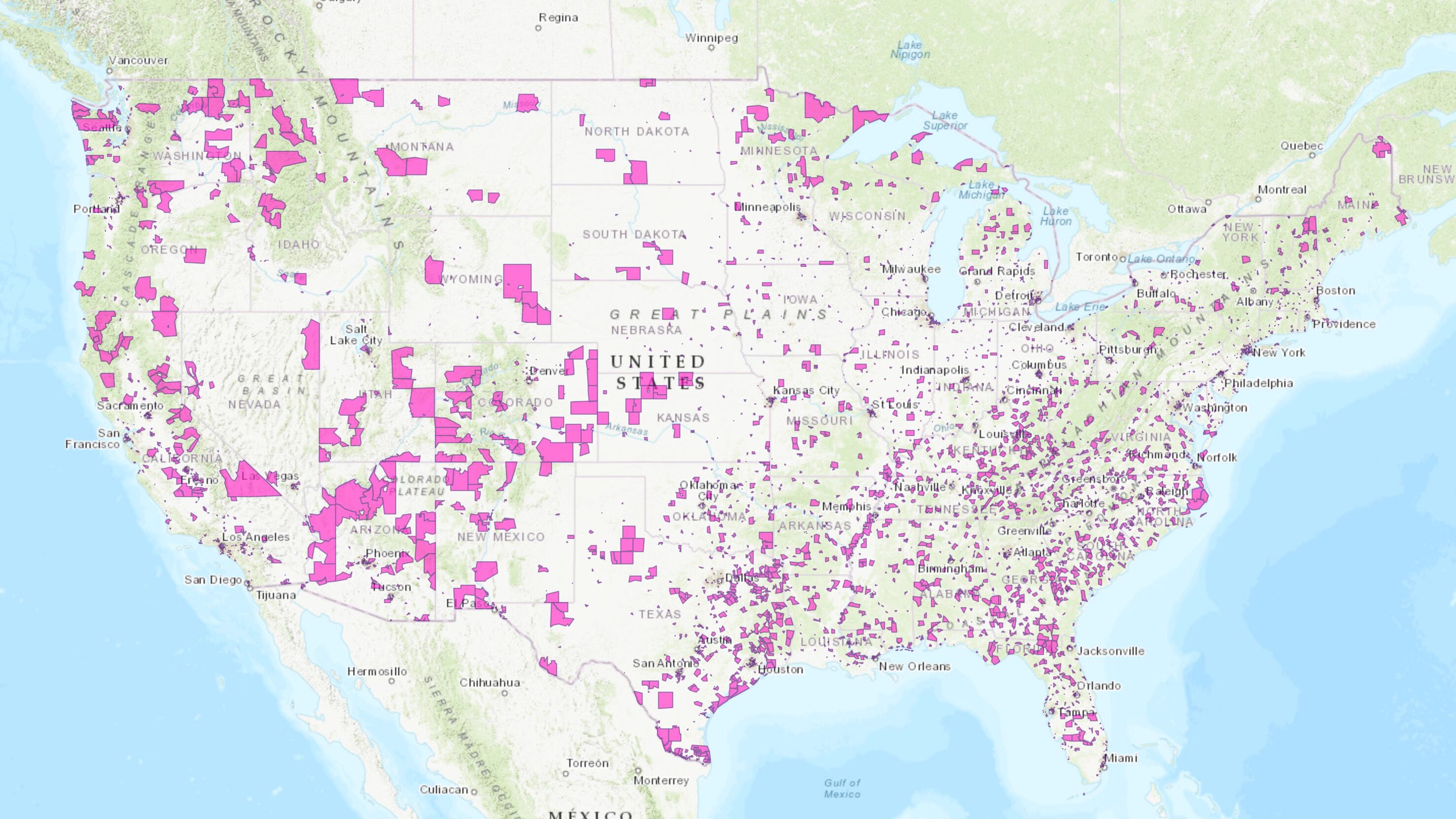

The zones were created by the Tax Cuts and Jobs Act on Dec. 22, 2017, when then-President Donald Trump signed a Republican tax bill into law. They give rich investors like Trump a way to avoid capital gains taxes by reinvesting profits from winning investments in deserving areas designated by the government (much of downtown Portland and the inner eastside is designated “O.Z.”).

Ever since then, Wyden has questioned whether Opportunity Zones help anyone but the rich. Recently, Wyden wrote to two cryptocurrency mining firms, asking for information about their operations to help him determine if they are bringing anything to the zones beyond a lot of computer hardware and electrical wire.

“Earlier this year, I launched an investigation into luxury real estate developments in Opportunity Zones that might shield wealthy investors from capital gains taxes in exchange for limited public benefit,” Wyden wrote to Redivider Blockchain Opportunity Zone LLC, based in Dover, Delaware. “I am similarly concerned by recent reports that companies involved in cryptocurrency mining may be seeking to avoid taxes without meaningfully benefitting distressed communities.”

The supplies of many cryptocurrencies, including bitcoin, are controlled by complex math problems that miners must solve to unlock new coins. The work requires expensive, powerful computers that gobble costly electricity.

Wyden wrote to Redivider Blockchain after company founder Tom Frazier told HuffPost on Feb. 9 that he was raising money from wealthy investors to build prefabricated, mobile computer centers that he’ll put in Opportunity Zones.

“We’re creating jobs where Americans need them,” Frazier told HuffPost.

Now, Wyden wants to know a whole lot about Frazier’s business. According to his letter, he wants Redivider to list all of the projects it has in Opportunity Zones, how much the company is investing, how many jobs each project will create, and what tax benefits Frazier expects to get from operating in an Opportunity Zone.

On his LinkedIn profile, Frazier says his “core value” is “being an Alfred type guy who built a Batman factory. I believe that amazing culture is a requirement to achieve meaningful results. I have a strict no a**hole policy in my life.”

In October, Redivider said it hired former Trump administration official Dan Kowalski as an adviser. Kowalski worked for Treasury Secretary Steven Mnuchin, where he “spearheaded IRS guidelines and reporting for the Opportunity Zone program at the Treasury Department,” according to a biography distributed by Marcum LLP for a conference.

Wyden sent a similar letter to Argo Blockchain, a crypto miner based in London that broke ground on a crypto-mining operation in Dickens County, Texas, in July. Argo CEO Peter Wall talked about Opportunity Zones with HuffPost, as did Blake Christian, a Utah-based accountant who specializes in the zones. He got a letter from Wyden, too.

Wyden questioned Christian on his comments in the HuffPost article, where he said that crypto mining and Opportunity Zones were “a perfect fit. They’ve just had this big windfall and invariably they’re looking for a way to save some money because they’re about to get drilled on short term capital gains taxes. And they want to keep rolling the dice.”

Redivider and Argo didn’t immediately return email seeking comment. Christian didn’t return email or a phone call.