Last month, a writer at the Motley Fool, a stock-picking service popular with tech-loving millennials, recommended buying shares of Dutch Bros.

“Want to retire early?” Justin Pope asked on fool.com. “Buy Dutch Bros. The flourishing coffee chain has all the makings of a long-term winner.”

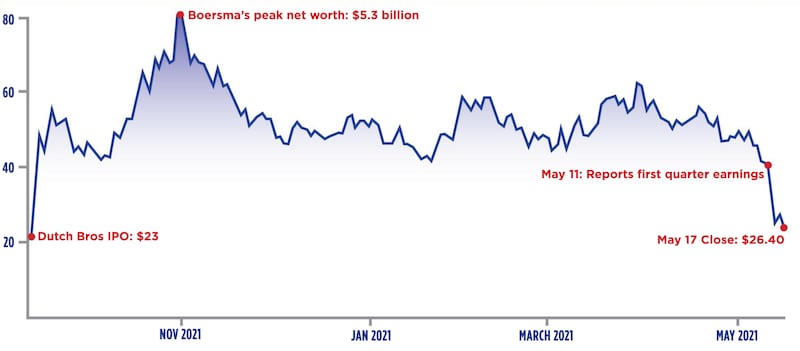

Maybe. But in the short term, one of the few people who might retire early thanks to Dutch Bros is company founder and Grants Pass native Travis Boersma, 51, who owns 65 million shares in the coffee company and became a billionaire when it sold shares to the public last September in what became Oregon’s largest-ever IPO (take that, Phil Knight). But he’s $517 million lighter after the events of last week.

The stock, which trades under the symbol “BROS,” plummeted 37% in after-hours trading May 11, when it reported quarterly earnings and warned that sales at existing stores, a key metric for restaurant stocks, would be “approximately flat” for 2022.

Higher prices for gas and other goods were soaking up dollars that Dutch Bros customers might otherwise spend on Rebel energy drinks and nitro-infused cold brews. Younger customers, especially, had “some discretionary income challenges,” CEO Joth Ricci said (his solution: hype the energy drinks with promotions!).

Investors hated the report and dumped the stock. On Tuesday, it closed at $26.40, up just $3.40, or 15% from its IPO price of $23. Boersma, meantime, is still doing pretty well. Filings with the Securities and Exchange Commission show that he and “affiliated entities” own 64,724,563 class A shares in Dutch Bros. At $26.40, his holdings are still worth $1.7 billion.

That’s down from $5.3 billion, Boersma’s worth late last year, when Dutch Bros soared to a record $81.40. But it’s still enough for anyone, except maybe a Saudi royal, to retire.

Anyone else who owns BROS should probably keep working. This chart traces the rise and fall of Dutch Bros.