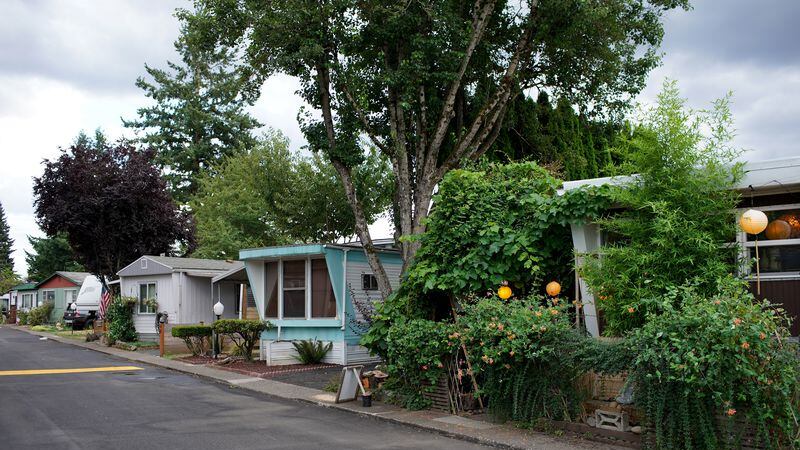

In a county desperately short of housing, the people most vulnerable are at the low end of the wage scale—including the more than 4,900 owners of manufactured homes in Multnomah County whose median income is $38,000. That means they bring in barely half the $73,000 average in the county.

Until today, manufactured home owners got a break—they didn’t pay property tax until their home’s assessed value topped $38,000, but they paid tax on the entire value once they crossed that threshold (the average assessed value for such homes was $40,740 last year.)

In a unanimous vote today, however, the Multnomah County Board of Commissioners raised that taxable threshold to $50,000. And if a manufactured home’s assessed value exceeds that amount, the owner will only pay tax on the value over $50,000, not on the whole amount.

“We’re lowering taxes for the people who need that relief the most,” said Commissioner Susheela Jayapal, who, along with Commissioner Lori Stegmann, proposed the resolution.

“There is more we can do, we must do, but this is a great step,” Stegmann added. “We are moving and we’re making a significant difference.”

County assessor Mike Vaughn’s office estimates the new program will cost the county about $350,000 and as much as $3 million across all affected taxing districts.

But Chair Deborah Kafoury, who helped pass legislation that allows local jurisdictions to make such changes as a state representative in 2009, said the lost revenue is more than worth the benefit to low-income homeowners.

“These are really vulnerable people,” Kafoury said. “Anything we can do to help them stay in our homes and not end up in homelessness is worth our time.”