The short life and predictable death earlier this month of House Bill 3312 to raise taxes on beer, cider and wine highlights the large discrepancy in the way Oregon taxes intoxicating substances.

Beer, cider and wine producers (and distributors of out-of-state products) pay an excise tax to the state of $2.60 per 31-gallon barrel for beer and cider, and 65 cents per gallon on wine. The Oregon Liquor and Cannabis Commission marks up the wholesale price of liquor about 100%, resulting in an indirect tax. Cannabis retailers charge buyers a 17% state tax.

Mike Marshall, executive director of Oregon Recovers, the advocacy group behind HB 3312, wanted to raise beer, cider and wine taxes to discourage consumption and increase funding for substance use disorder. Marshall seemed to expect defeat even as he unveiled the proposed tax March 15, noting then it wasn’t scheduled for a hearing by the March 17 deadline.

And, sure enough, the bill died. That means the beer tax (last increased in 1977) and the wine tax (last raised in 1983) remain unchanged.

Marshall blames the bill’s arrival nearly two months after the session started on poor workmanship. “It’s up to Legislative Counsel to get bills out on time,” Marshall says. “But when alcohol is killing six Oregonians a day, you have to really wonder why they took so long on a bill designed to fund and provide immediate access to detox and treatment.”

The Oregon Beverage Alliance, which represents the beer, cider and wine industries, defends the current level of taxation on its members’ products, noting the state is in the liquor business specifically to generate revenue, while it is not in the other businesses.

“This is not an apples-to-apples comparison,” says Ramsey Cox, a spokeswoman for the alliance. The state now spends only 3% of liquor revenue on addiction, Cox adds, so it could allocate more liquor money to public health if that’s a priority.

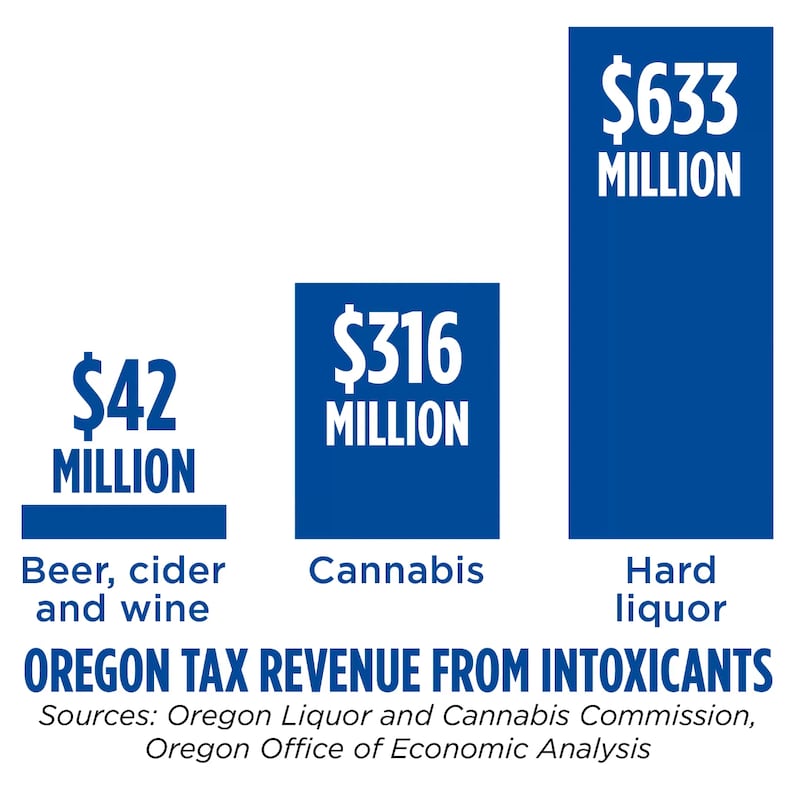

Here’s how much revenue each of the substances is projected to raise for the state in the next two years: