A flurry of new documents WW has obtained under a public records request show that Ross Island Sand & Gravel, part of R.B. Pamplin Corp., is failing to meet its legal obligation to refill the massive hole it dug while mining the Willamette River bottom from 1926 to 2001.

The documents show Ross Island Sand & Gravel—controlled by Dr. Robert Pamplin Jr., whose industrial empire also includes 24 Oregon newspapers, such as the Portland Tribune, and a textile business in the American South—hasn’t met its financial commitment or its responsibility to reclaim river bottom and upland habitat scarred by decades of mining.

“Ross Island is an incredibly important natural resource for the city and the people of Portland,” says Bob Sallinger, conservation director of Willamette Riverkeeper. “It’s essential to get the island restored.”

The company now faces state penalties, and emails hint Pamplin himself may face larger problems.

WHAT DIDN’T HAPPEN?

After RISG stopped mining the Willamette River bottom in 2001, it struck a 2002 deal with the Oregon Department of State Lands, which regulates in-water work, to refill a hole that reached 120 feet deep. Over the next 20 years, the company barged in 480,000 cubic yards of dirt and rock, an average of 24,000 cubic yards a year.

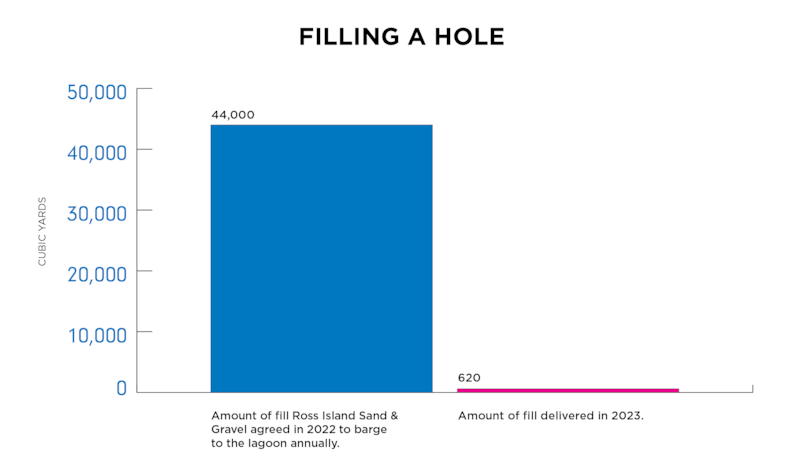

In 2022, the state and the company renegotiated the fill agreement: RISG got more time and, in exchange, agreed to bring in an average of 44,000 cubic yards each year through 2033. It got off to a slow start last year, bringing in just 620 cubic yards. “It’s clear RISG will need to significantly increase fill placement in the next two years to comply with this requirement and avoid future enforcement action,” says DSL spokeswoman Ali Hansen.

WAS THERE A BACKUP PLAN?

When the state and Ross Island renegotiated the fill agreement in 2022, state officials sought assurance the company could finish the job. That assurance: a $6 million completion bond, a financial instrument that would effectively insure against failure to refill the lagoon.

As part of the agreement, RISG promised to post the $6 million bond with the state by May 31, 2023. But emails show, starting the week the bond was due, RISG president Randy Steed presented the state with a string of excuses and apologies in lieu of the bond—and continued to make excuses throughout 2023.

One complication: As WW has previously reported, Robert Pamplin Jr., acting as both CEO of the operating company and trustee for the Pamplin pension fund, sold most of Ross Island to the pension fund in 2022 for $10.8 million (despite having previously argued in court that it had little or no value). Steed told DSL on Dec. 13 that the bonding company required audited financials from R.B Pamplin Corp. and the pension fund before providing a guarantee, and that requirement “presented an additional hurdle.”

Steed acknowledged his excuses were falling flat. “I have been wrong on timing at each turn,” he told DSL. “Dr. Pamplin is aware of the bond tardiness and is reminded each time I have a chance to gripe.”

The bond is now nearly a year overdue.

WHAT’S THE STATE DOING ABOUT IT?

On May 17, DSL slapped Ross Island with notice of a $2.9 million penalty. In addition to failing to post the required bond, DSL wrote in the notice, RISG had failed to obtain a required dredging application; improperly placed fill in shallow water; and, on five occasions, allegedly moored a barge transporting clean fill too close to an eagle’s nest. RISG has 20 days from May 17 to seek a hearing on the penalty. Company officials declined to comment.

WHAT ELSE DID THE RECORDS SHOW?

In his explanation why RISG could not post the $6 million bond, Steed dropped a nugget of information that suggests changes are afoot at the $100 million Pamplin pension fund.

As WW has reported, Robert Pamplin Jr. has been the trustee of that fund for decades but, in recent years, has sold dozens of parcels of unused industrial Pamplin property to the fund, seemingly to raise cash for the operating companies. Pension experts have told WW those transactions are imprudent for the fund, exposing thousands of pensioners to excessive risk, and probably violate pension laws.

On Dec. 13, Steed told DSL that Robert Pamplin is no longer the trustee of the pension fund. “The new trustee toured the facilities with RB Pamplin staff the week prior to Thanksgiving,” Steed wrote to DSL.

Neither the U.S. Department of Labor nor Pamplin officials would comment on the change. Whatever is happening with the company, Sallinger says he hopes the reclamation will continue. “Our expectation after the new agreement last year was that Ross Island Sand & Gravel was fully committed,” he says. “I give the state credit for going after them in a meaningful way.”