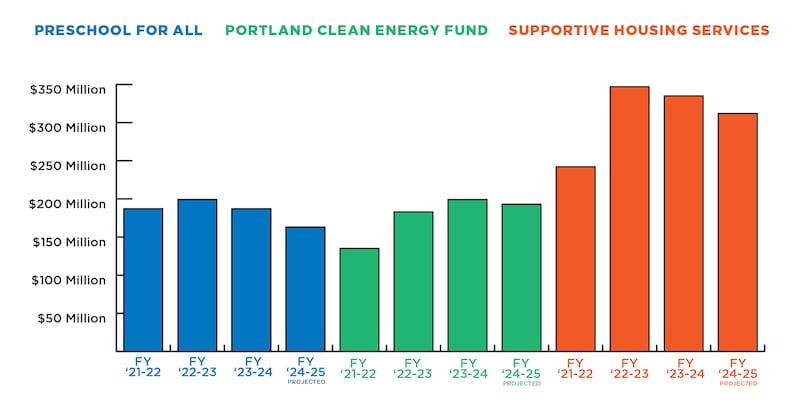

A flurry of progressive taxes that Portland-area voters passed in recent years continue to rake in a combined hundreds of millions of dollars, though economists believe revenues will drop modestly in the current fiscal year.

Elected officials with ties to the business community have taken to calling the three Portland-area taxes on high-income earners and businesses the “Big Three.” Portland City Commissioner Dan Ryan spoke frequently this year of “right-sizing” the tax burden, saying the trio of taxes would drive high-income earners out of the city. Recent population data offers conflicting evidence: IRS numbers show more taxable income left Multnomah County in recent years than arrived, but the number of households making more than $200,000 a year has actually increased over the past two years.

Here’s what the Big Three collected in the past three years, and what they’re projected to pull in this current fiscal year. Projections show that, while revenues are still sky-high, they’re slightly less impressive than in recent years.

PRESCHOOL FOR ALL

Multnomah County’s Preschool for All tax levies a 1.5% income tax on households earning more than $200,000 and 3% on families making more than $400,000. The proceeds fund a universal preschool program that the county says will eventually grow to 12,000 seats. The program has struggled so far to create new seats and relies on existing child care providers.

FY ’21-22: $187 million

FY ’22-23: $199 million

FY ’23-24: $187 million

FY ’24-25, projected: $163 million

PORTLAND CLEAN ENERGY FUND

The Portland Clean Energy Fund levies a 1% tax on sales by businesses that make more than $500,000 locally per year and more than $1 billion nationally. City officials have struggled to keep up spending as revenues have far exceeded what economists projected the tax would bring in. Earlier this year, in an effort to use some of the excess revenues to fill a larger city budget deficit, the City Council pledged hundreds of millions of PCEF dollars to climate-related projects within city bureaus.

FY ’21-22: $135 million

FY ’22-23: $183 million

FY ’23-24: $199 million

FY ’24-25, projected: $193 million

SUPPORTIVE HOUSING SERVICES

Finally, regional government Metro’s supportive housing services tax has also exceeded projected revenues. The tax, aimed at getting people off the streets, levies a 1% income tax in Multnomah, Washington and Clackamas counties on individuals earning more than $125,000 a year and households earning more than $200,000. The revenue is then distributed to the three counties to spend. While Multnomah County has struggled for years to spend the money on pace, the county insists it’s catching up now and is putting the dollars to good use. Metro officials are weighing a ballot measure to index the tax and extend it for an additional 20 years.

FY ’21-22: $242 million

FY ’22-23: $347 million

FY ’23-24: $335 million

FY ’24-25, projected: $323 million