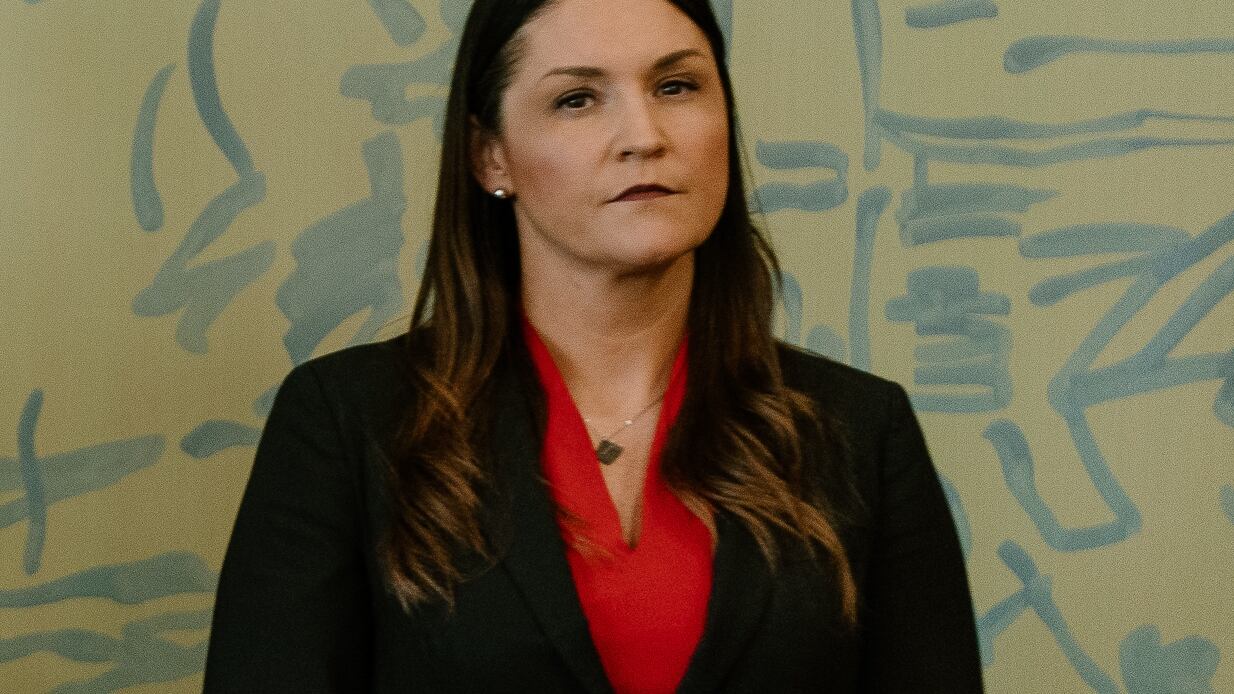

Records show that the U.S. Department of Justice is taking a closer look at former Oregon Secretary of State Shemia Fagan’s tax filings.

On Dec. 6, the U.S. District Court for the District of Oregon subpoenaed the Oregon Department of Revenue, requiring the state agency to provide Shemia Fagan’s state income tax returns since 2020, as well as any “background, civil, and criminal investigative files” relating to Fagan.

That subpoena is the latest window into the scope and intent of the federal investigation into Fagan launched in May, shortly after WW revealed that she had signed a $10,000 per month independent consulting contract with two of her top donors and the co-founders of the embattled La Mota cannabis company, Aaron Mitchell and Rosa Cazares, in February.

Back in May, the scope of the inquiry appeared broad, with wide-ranging subpoenas issued to five state agencies, including the Oregon Department of Revenue.

The Dec. 6 subpoena is much narrower than the scope of the initial subpoena, zeroing in on Fagan alone. It also shifts the focus to Fagan’s tax records. (The earlier subpoena asked for only the income tax returns of Mitchell and Cazares, not Fagan.)

As WW reported earlier, Fagan’s personal finances were in dire shape prior to her decision to moonlight for a La Mota subsidiary. The feds’ interest in the state tax returns she filed after running for secretary of state in 2020 suggest they want a fuller understanding of what income she declared as well as other aspects of her financial condition.

It’s unclear if the new document represents a refining of the earlier investigation or is related to an additional probe.

As it turned out, the feds never needed to subpoena Fagan’s state tax filings—they had them already, says the Oregon Department of Justice, which represents state agencies in legal matters. Agency spokesman Roy Kaufmann says the Oregon DOJ never accepted the subpoena on behalf of their client, the state treasury.

“It’s routine to receive copies of documents prior to determining whether we will accept service on behalf of a client,” says Kaufmann.

While it never got into the hands of Oregon’s Department of Revenue, the subpoena, obtained by WW, shows the feds are interested in what Fagan declared on her state tax return. (The feds, through the Internal Revenue Service, already have access to her federal tax return.)

An attorney representing Fagan did not immediately respond to a request for comment.

Earlier this week, WW reported that former associates of Mitchell and Cazares had recently been approached by FBI and Internal Revenue Service special agents about the couple’s business practices and their lifestyle, including what cars they drive and what properties they own. It’s unclear how closely tied the two investigations are, or if they are branches of the same investigation.