Oregon State Treasurer Tobias Read will present his plan for reducing the emissions intensity of his agency’s investments to the Oregon Investment Council on Feb. 6.

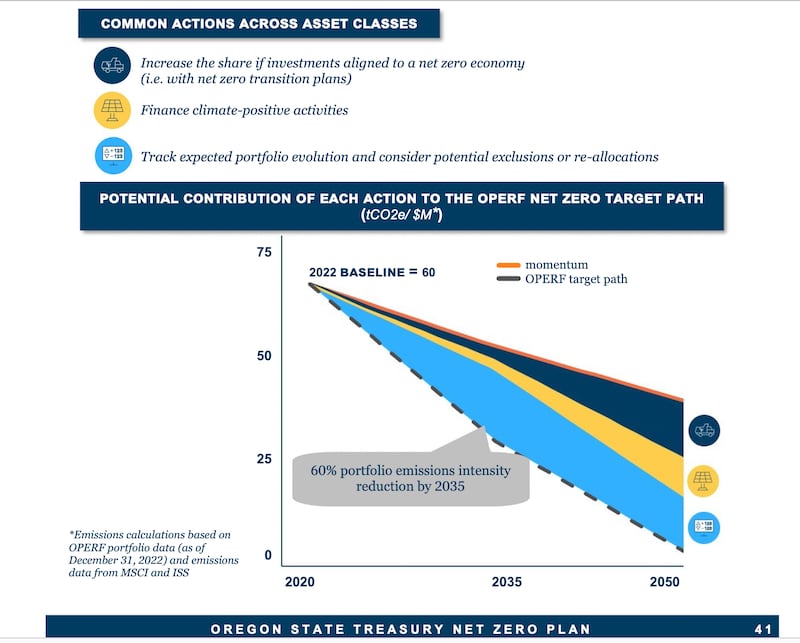

In a new report, Read has outlined a plan to cut the investment portfolio’s emissions intensity—a measurement of tons of CO2 emissions per million dollars of assets under management—by 60% by 2035 and to net zero by 2050.

Working with consultants, the Oregon State Treasury used the Oregon Public Employees Retirement Fund portfolio in 2022 as the baseline for reductions. That portfolio was worth $91.9 billion but reduced for some investments that are short term or over which the treasury has insufficient control to mandate changes. That left a value of $73.2 billion, or 80% of the treasury’s total holdings, that are subject to the emissions reduction pledge.

The agency established emission reduction goals that parallels those planned by other large pension funds in California, New York and Canada, and come in response to international agreements to combat climate change.

“We are aiming for a 60% emissions intensity reduction by our interim date of 2035, which is equivalent to a 50% reduction in absolute emissions and is largely consistent with targets and dates set by our peers,” the report says. After reaching that interim reduction, the treasury plans to get to net zero by 2050.

It plans to do so through a combination of strategies. Broadly speaking, those will include investing in companies that have net zero plans of their own, increasing investments in green energy, and reducing investments or not investing in companies that generate emissions.

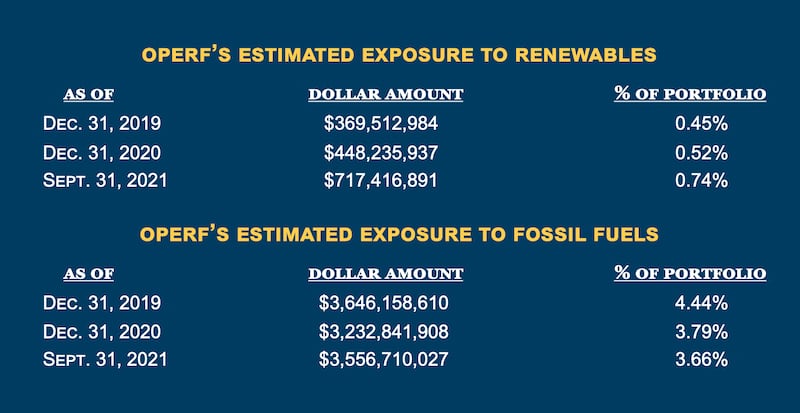

Here’s a snapshot of how the portfolio in 2021 looked in terms of those approaches:

“By prioritizing strategies that support transition and de-carbonization, we avoid simply shifting the emissions burden to other investors or trying to make our numbers look better on paper while not doing anything to mitigate climate change in a meaningful way,” the plan says.

Climate activists have pushed Read, who is term-limited from seeking reelection and now running for secretary of state, to act aggressively to decarbonize pension investments. Their case is compelling: The world is getting hotter, with all kinds of impacts now and in the future for Oregon and everyone else.

At the same time, Read and the Oregon Investment Council are responsible for maximizing returns for the 405,000 members of the Oregon Public Employees Retirement System. It is their fiduciary responsibility to do so—and, as the report notes, the risk of generating lower returns not only hurts pensioners, it increases the amounts government employers have to set aside.

“A rashly implemented net zero plan that lowers investment returns would mean an increase in OPERF’s unfunded liability. A larger unfunded liability would require larger contributions from employers and their employees,” the report says. “When public entities have to direct more money to cover their retirement system obligations, they have less money for the classroom, the firehouse, child welfare offices, and other state and local government services.”