Attorney General-elect Dan Rayfield reported a $20,000 contribution Dec. 2 from Philip Morris International Global Services.

It’s not Rayfield’s first check from a Philip Morris affiliate: He got $2,500 in 2022 and again in 2023 from Altria Client Services, another Philip Morris company, and $2,000 from Philip Morris International during his race this year against Republican Will Lathrop.

But those smaller checks came before Rayfield, 45, won the Nov. 5 election to become the state’s chief legal officer. In that role, he will oversee the state’s litigation strategy, including whether to sue certain companies that state officials believe are causing harm to Oregonians. In the past, of course, many states, including Oregon, sued Philip Morris (now Altria) and other tobacco companies for false advertising and the public harm tobacco has done.

Tobacco companies are set to pay out more than $180 billion over the life of the settlements with various states. Oregon took an aggressive stance in the litigation and has so far received $1.89 billion from the settlements since 1998. More recently, Oregon led national litigation against the vaping company Juul Labs that resulted in a $438 million settlement.

Philip Morris International began the U.S. rollout this year of a product called iQOS that heats tobacco to release nicotine, rather than burning it. (The company has been selling iQOS overseas for several years.) In at least two states, Mississippi and Nevada, according to the industry news site Tobacco Insider, the company has lobbied to have the new product taxed at a lower rate than cigarettes, for which it can serve as a replacement.

Records show Philip Morris International hired lobbyists in Oregon last year to represent the company on “matters concerning heated tobacco products” and has since spent $121,126 on that lobbying.

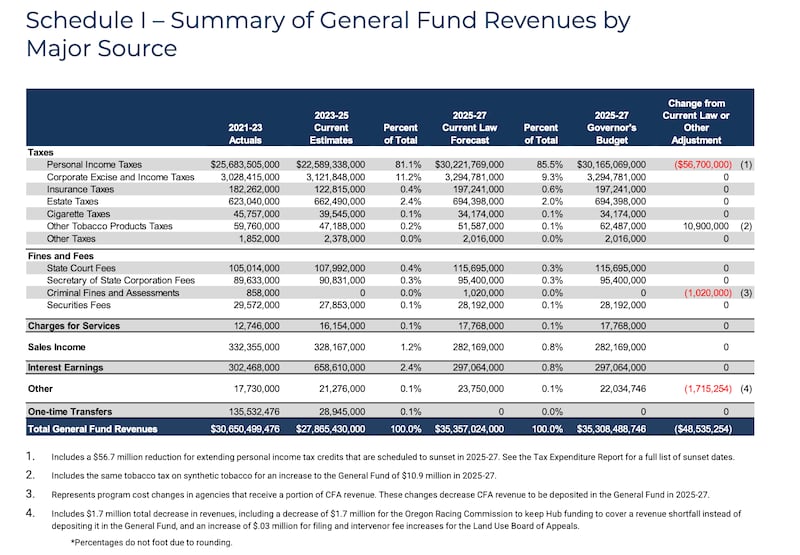

Oregon has been aggressive in taxing tobacco products. In fact, the only tax increase that shows up in the proposed budget Gov. Tina Kotek released this week is a $10.9 million increase in taxes on “synthetic tobacco.” That’s a small number in the context of the state’s general fund but would be a more than 20% increase in revenue from the category of “other tobacco product taxes.”

Oregon Health Authority spokesman Jonathan Modie says the increase comes from “revenue that’s anticipated should synthetic nicotine products be classified as tobacco products and taxed the same way that traditional nicotine products are, as is being proposed during the upcoming legislative session.”

It’s unclear what the regulatory or tax treatment in Oregon will be for heated tobacco, although, Modie says, “Our understanding is that heat-not-burn products such as iQOS are made from tobacco and would therefore be included under Oregon’s existing tobacco product laws.”

Meanwhile, a coalition of anti-smoking groups hopes to knock iQOS out of Oregon before it catches a toehold by including it in a proposed statewide ban on flavored tobacco products lawmakers will consider next year.

“These products still derive their nicotine from tobacco leaves, meaning that they still fit under the ‘nicotine inhalant delivery device’ definitions in Oregon for the purposes of regulation, and would be captured by the proposed restriction on flavored tobacco products if the Flavors Hook Oregon Kids coalition is successful in 2025,” says Jamie Dunphy, a spokesman for the American Cancer Society Action Network.

There’s another reason Rayfield’s check from Philip Morris International is notable: Since he entered the Legislature in 2015, Rayfield has been one of the loudest voices for campaign finance reform. “Democracy reforms like Ranked Choice Voting and Campaign Finance Reform have been lifelong priorities for me personally and big reason I got involved with politics,” Rayfield said on X on Aug. 28.

For decades, Oregon was one of only a few states that place no limits on campaign contributions. The former House speaker was a big part of the reason that lawmakers finally passed limits earlier this year, although those limits don’t go into effect until 2027. A big part of the push: reducing the influence of corporate money.

Rayfield’s spokeswoman, Hazel Tylinski, says the Philip Morris International contribution will have no influence on Rayfield’s work as attorney general.

“Attorney General-elect Rayfield firmly believes that campaign contributions are for campaign expenses and should have no bearing on the official work of any elected official,” Tylinski says. “AG-elect Rayfield has a decade of service demonstrating his independence on all issues from supporting and speaking out in favor of increased tobacco taxes to democracy reforms like campaign finance reform. This will continue to be his method of operation as Oregon’s next attorney general.”